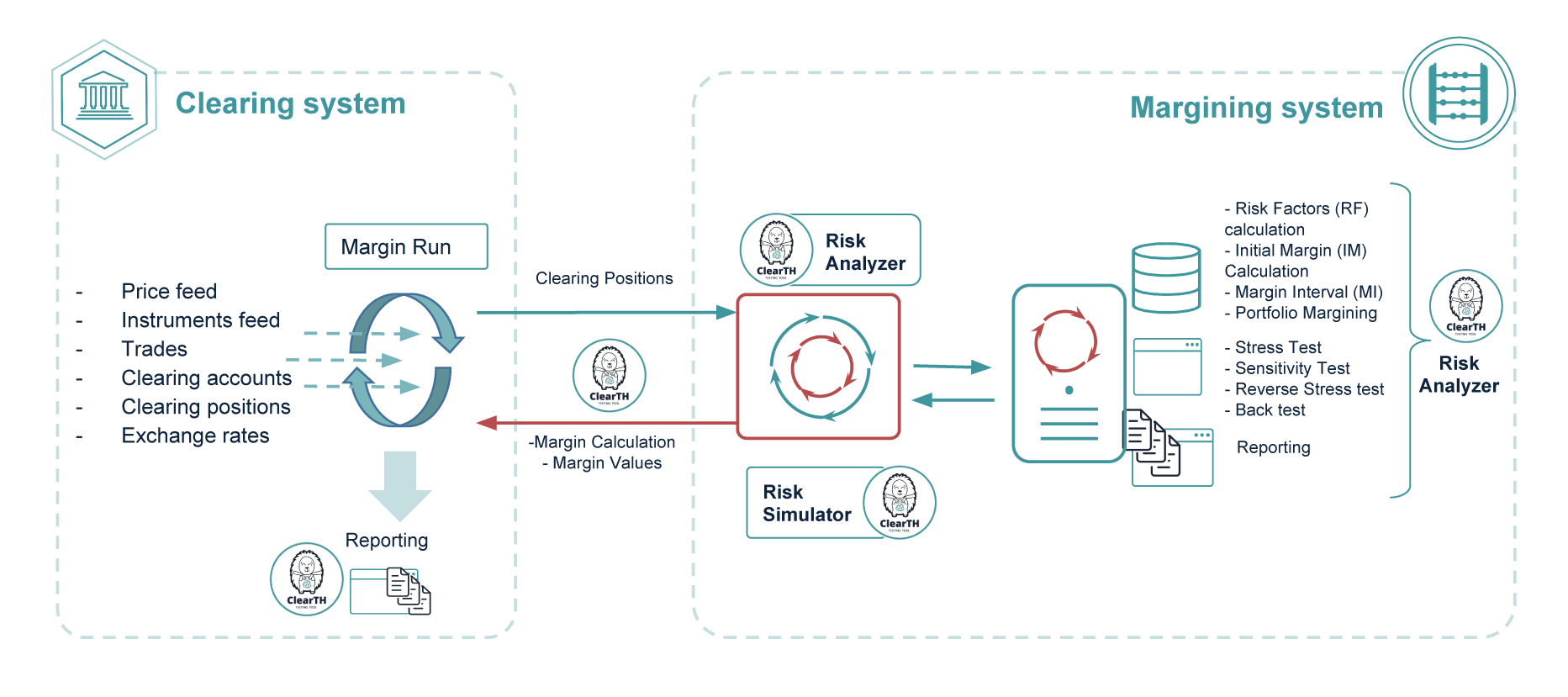

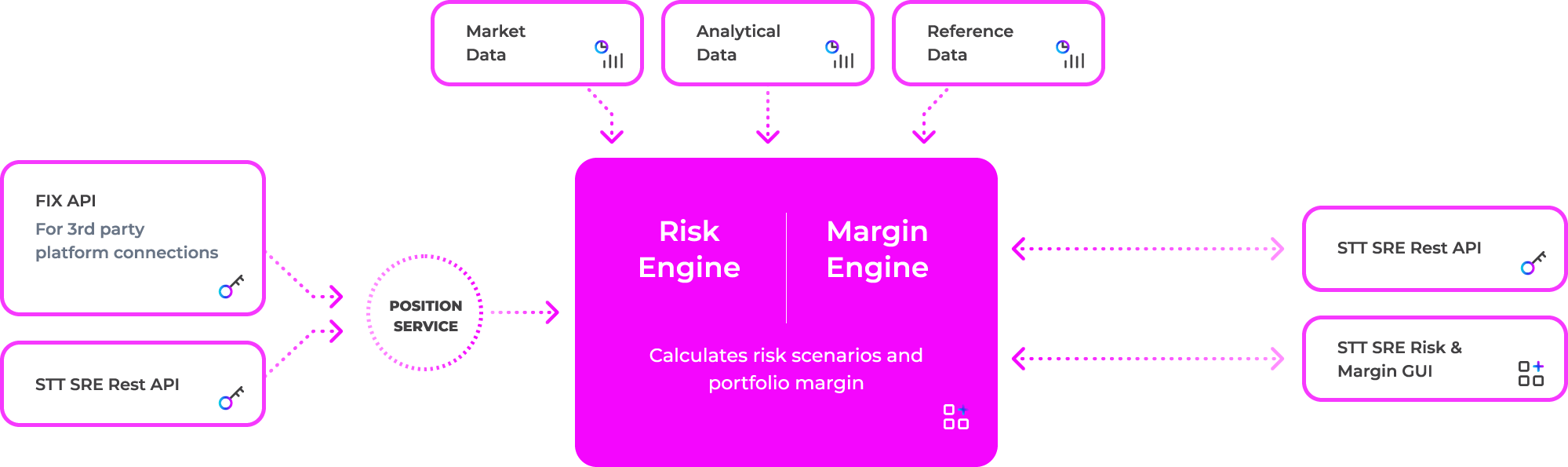

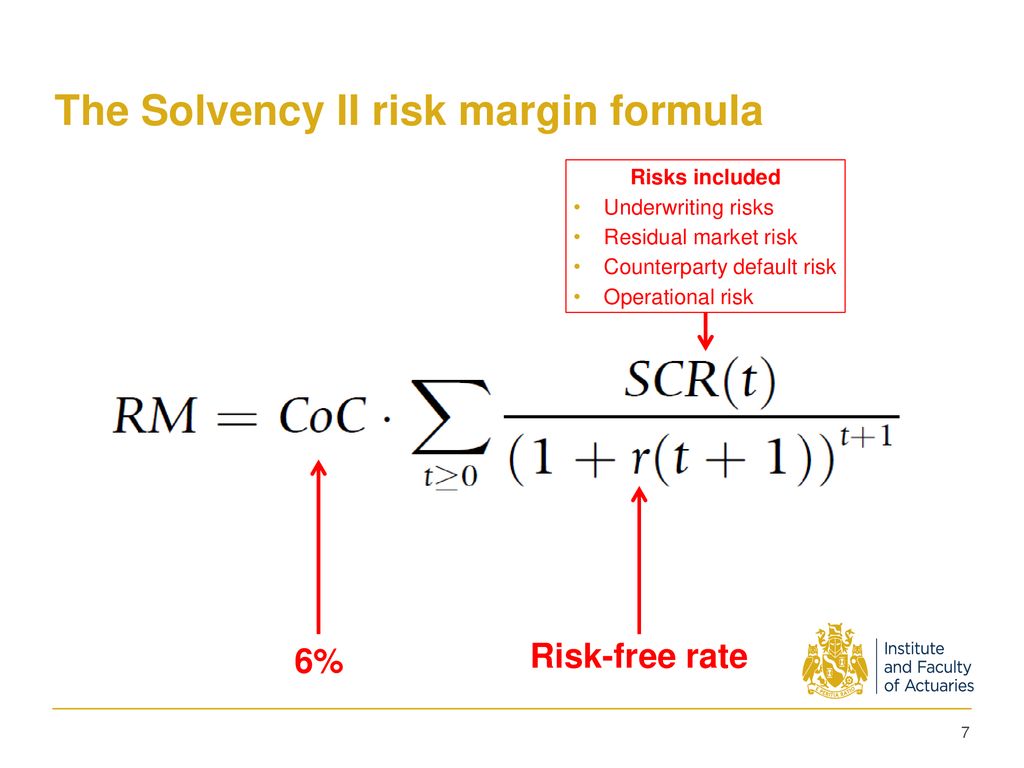

Margin Requirement Calculation Step 1 A = Initial Margin Multiplier * Risk Margin = 1.75 * Risk Margin Step 2 If the port has o

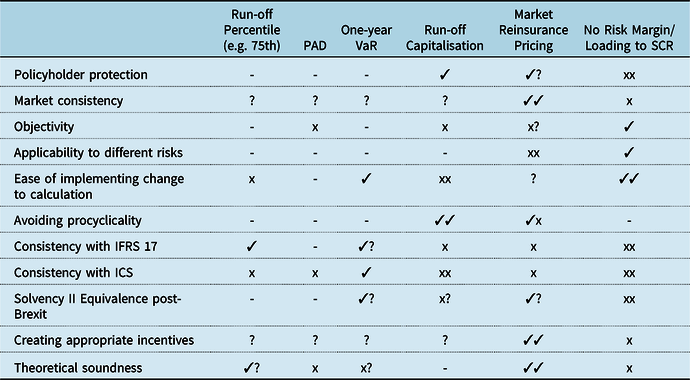

The Financial, Insurance & Investment Blog: Provision of Risk Margin for Adverse Deviation (PRAD) Models - Characteristics, Pros and Cons

:max_bytes(150000):strip_icc()/operating-margin-e2c7fa16a9e4466684193c7966c91860.jpg)