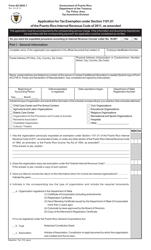

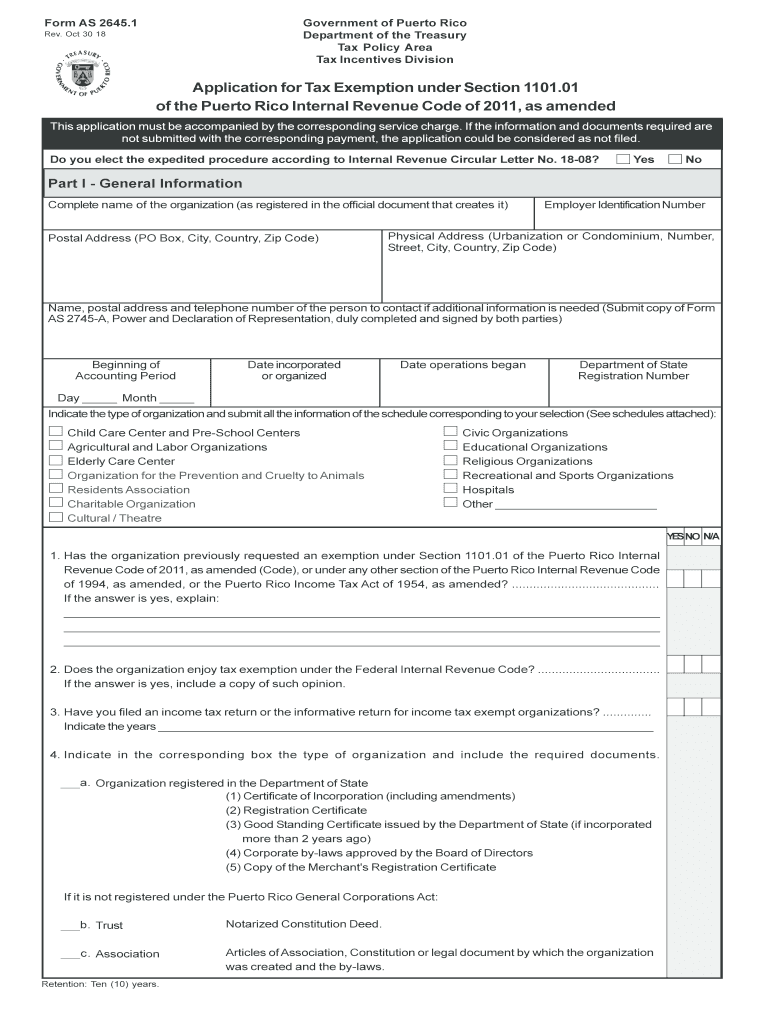

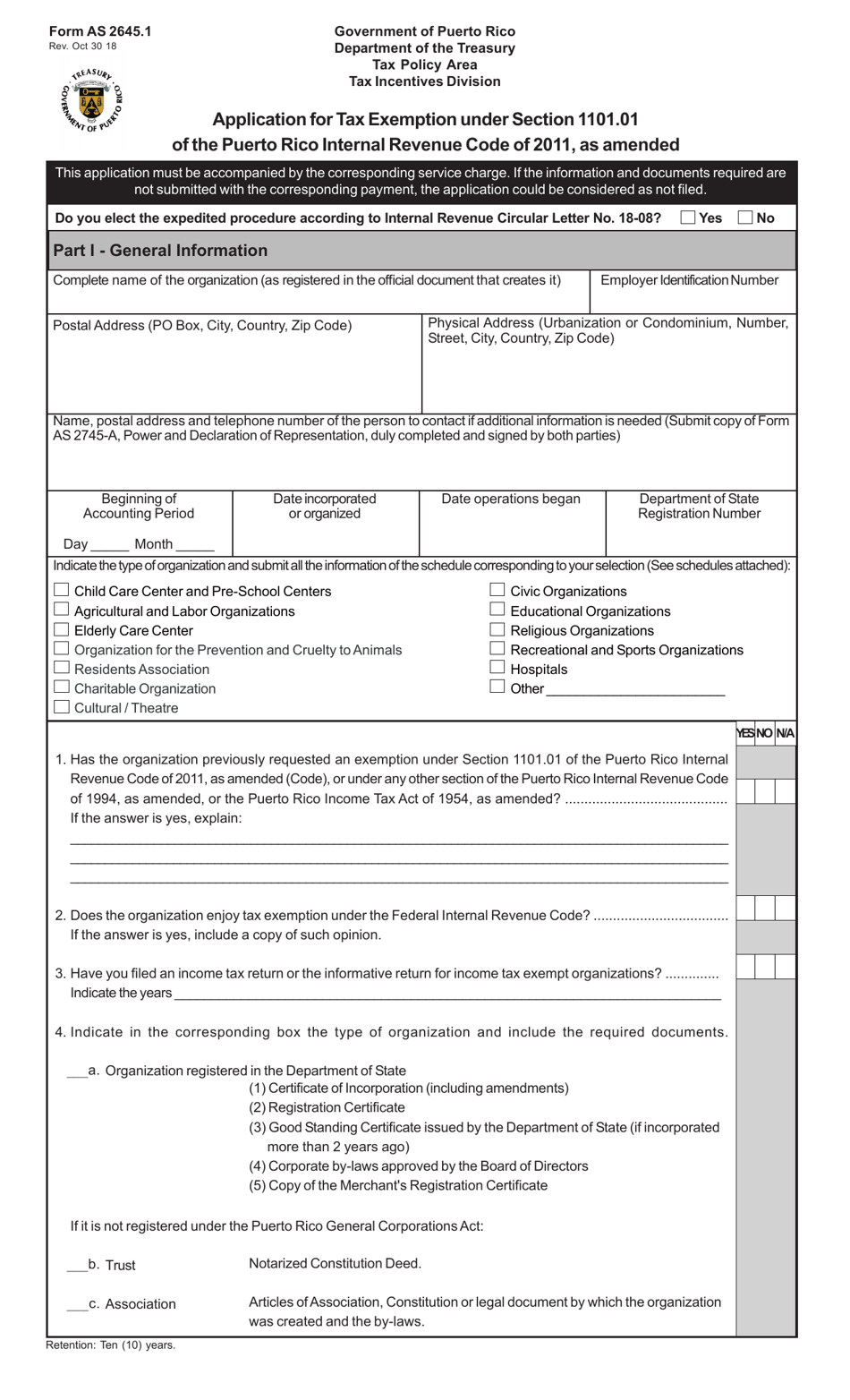

Form AS2645.1 Download Printable PDF or Fill Online Application for Tax Exemption Under Section 1101.01 of the Puerto Rico Internal Revenue Code of 2011, as Amended Puerto Rico | Templateroller

Limits that Apply to 2020 Retirement Plans Qualified by the 2011 Internal Revenue Code of Puerto Rico - Torres CPA

Puerto Rico Treasury Issues New Guidance on Rules and Procedures for Qualification of Retirement Plans

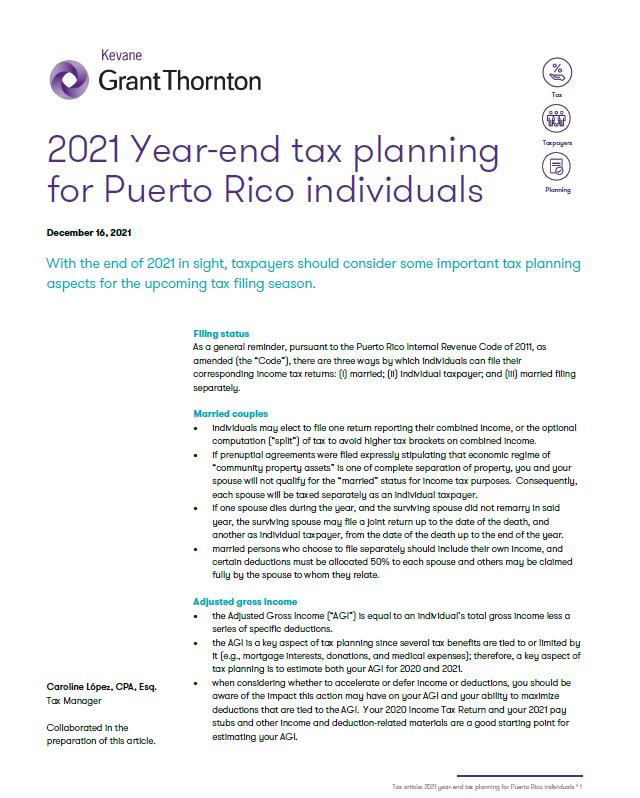

TAX ALERT Amendments to the Puerto Rico Internal Revenue Code of 2011: House Bills 1073, 1172 and 991 signed into Law

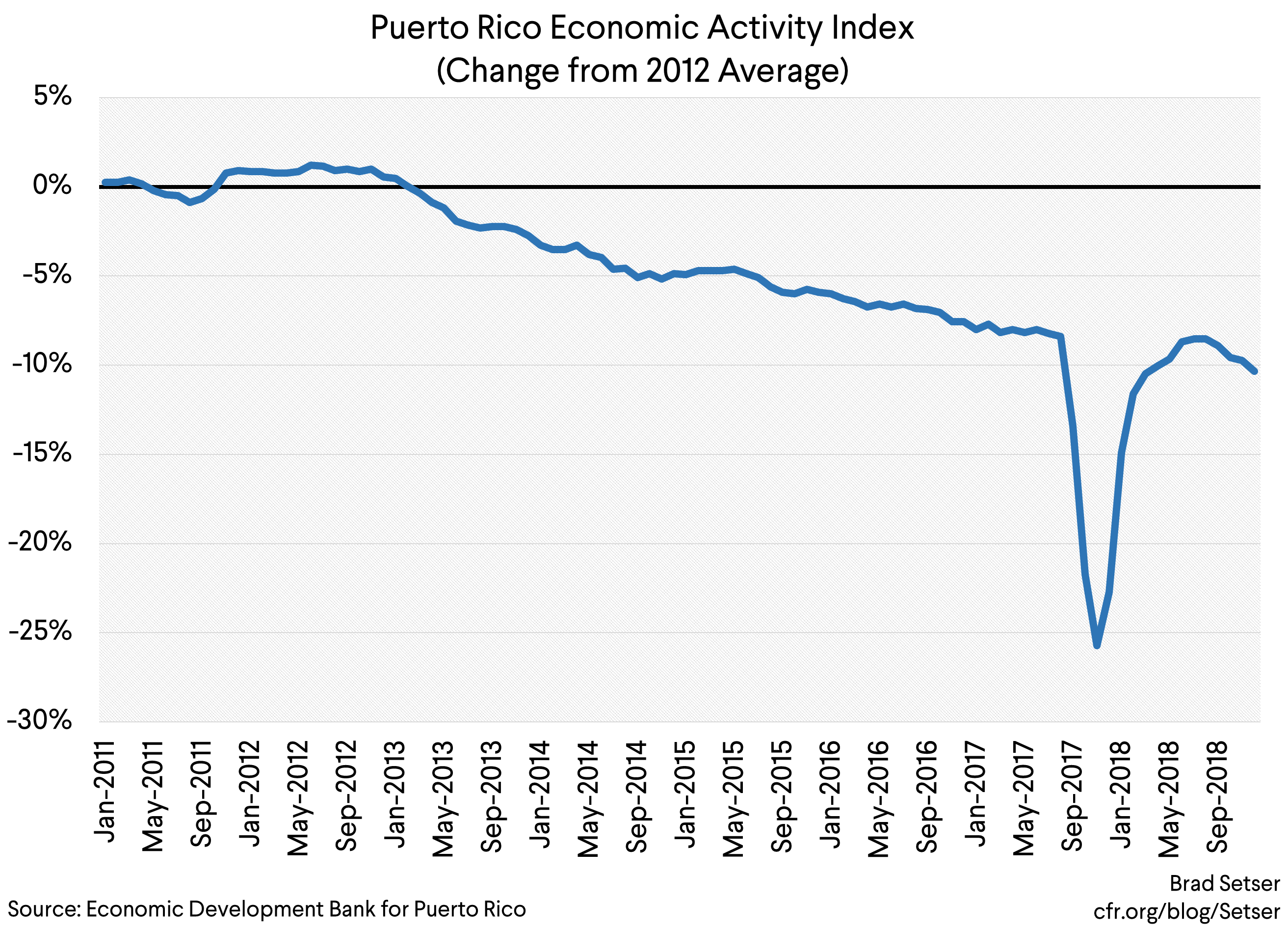

Is There Still A Path that Returns Puerto Rico to Debt Sustainability? | Council on Foreign Relations