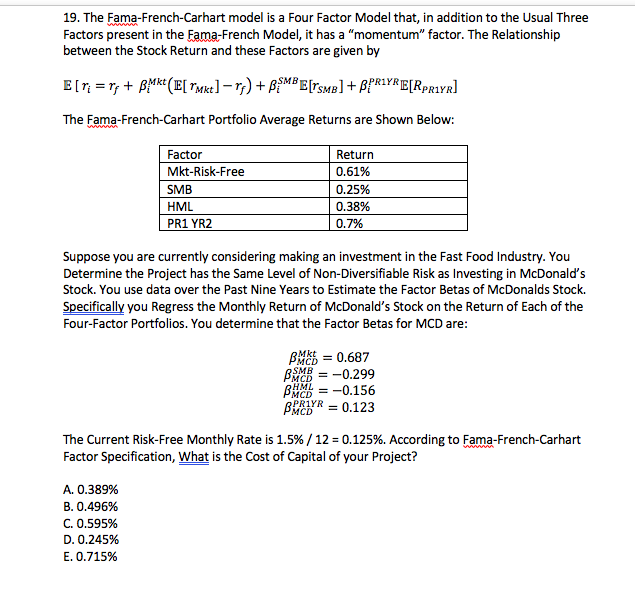

Fama-French 3, Carhart 4, Fama-French 5 Factor models return borderline 0% R2 (max. 6.6%). Time series regression - Quantitative Finance Stack Exchange

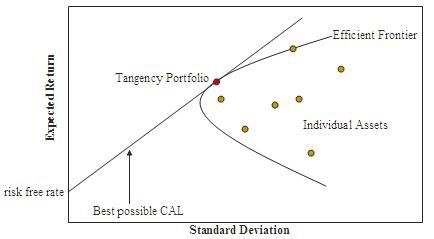

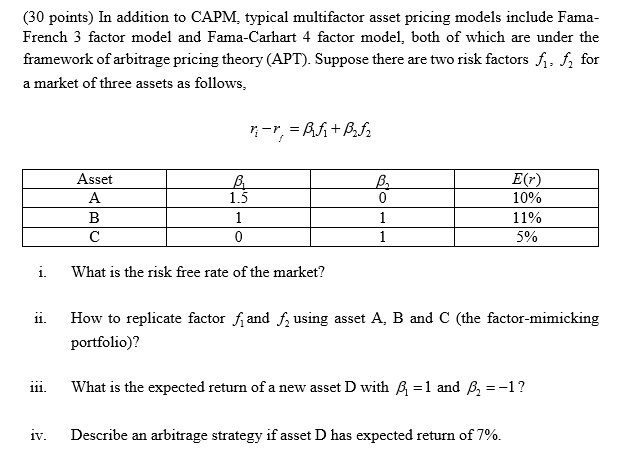

SOLVED: 30 points In addition to CAPM,typical multifactor asset pricing models include Fama- French 3 factor model and Fama-Carhart 4 factor model, both of which are under the framework of arbitrage pricing

Constructing and Testing Alternative Versions of the Fama–French and Carhart Models in the UK - Gregory - 2013 - Journal of Business Finance & Accounting - Wiley Online Library

SciELO - Brasil - The Earnings/Price Risk Factor in Capital Asset Pricing Models The Earnings/Price Risk Factor in Capital Asset Pricing Models

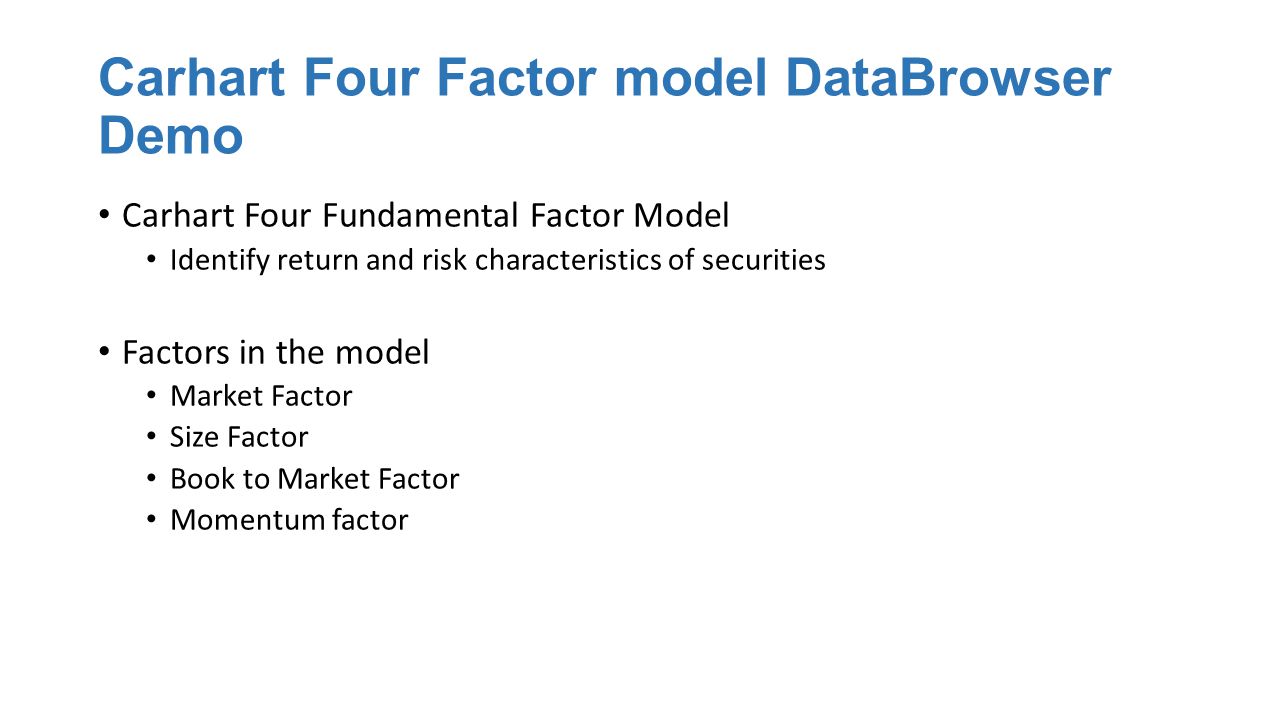

Construction of the Fama-French-Carhart four factors model for the Swedish Stock Market using the Finbas data

The pricing of anomalies using factor models: a test in Latin American markets. - Document - Gale Academic OneFile

SciELO - Brasil - The Earnings/Price Risk Factor in Capital Asset Pricing Models The Earnings/Price Risk Factor in Capital Asset Pricing Models